BNPPRE Dashboards

The BNP Paribas Real Estate Dashboards offer us a wide range of opportunities to present real estate markets digitally and interactively. Be it at your desk or when out and about, their responsive layout enables you to view, analyse and discuss the latest market developments in different asset classes on your smartphone, tablet, PC or laptop. What’s more, the integrated filter function allows you to clearly view and compare large amounts of data at a glance. Why open a multitude of individual files or carry around pages upon pages of documents when you can quickly access an up-to-date market or location overview with just a tap or a click?

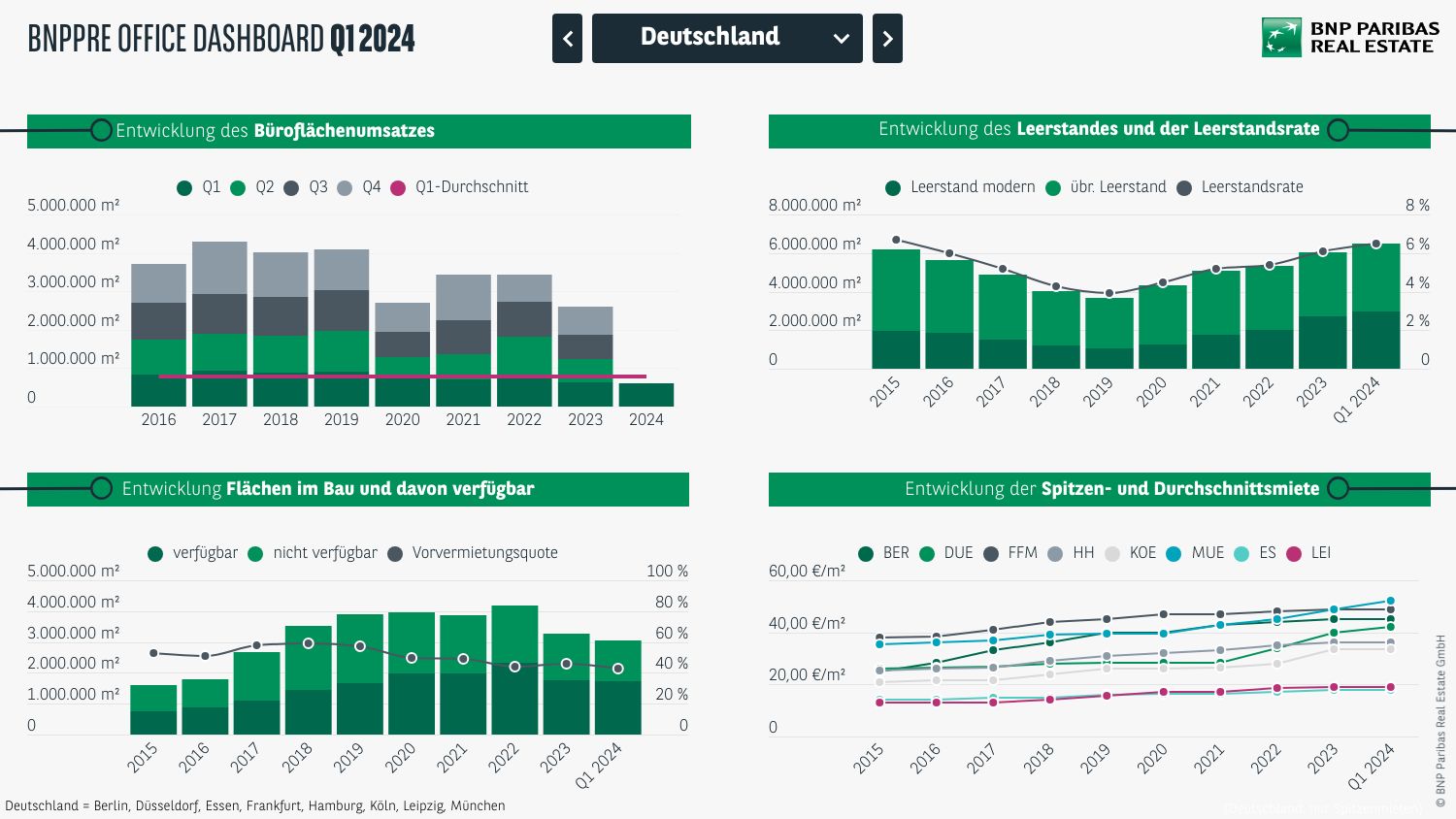

Office market key figures

Office market Q4 2025

In an environment that remains challenging, Germany’s office markets have matched the previous year’s result. Office take-up in Germany’s key markets - Berlin, Düsseldorf, Essen, Frankfurt, Hamburg, Cologne, Leipzig and Munich - amounted to 2.7 million square metres for the total year 2025, representing a slight increase of 1.4% compared with 2024. Market development was shaped above all by large, signal-setting deals at the beginning of the year and a marked rise in letting activity within the medium-sized segment, although not all markets were able to participate in these positive results. Companies are approaching decisions on offices more actively - often after a long analysis phase, but subsequently with swift implementation. The driving factor remains the “flight to quality”. For 2026, we anticipate a further moderate revival in leasing activity, especially if the filled decision pipelines result in more contracts in the second half of the year - particularly in the large-scale segment. Nonetheless, external factors, such as trade and geopolitical conflicts, may continue to cause short-term volatility.

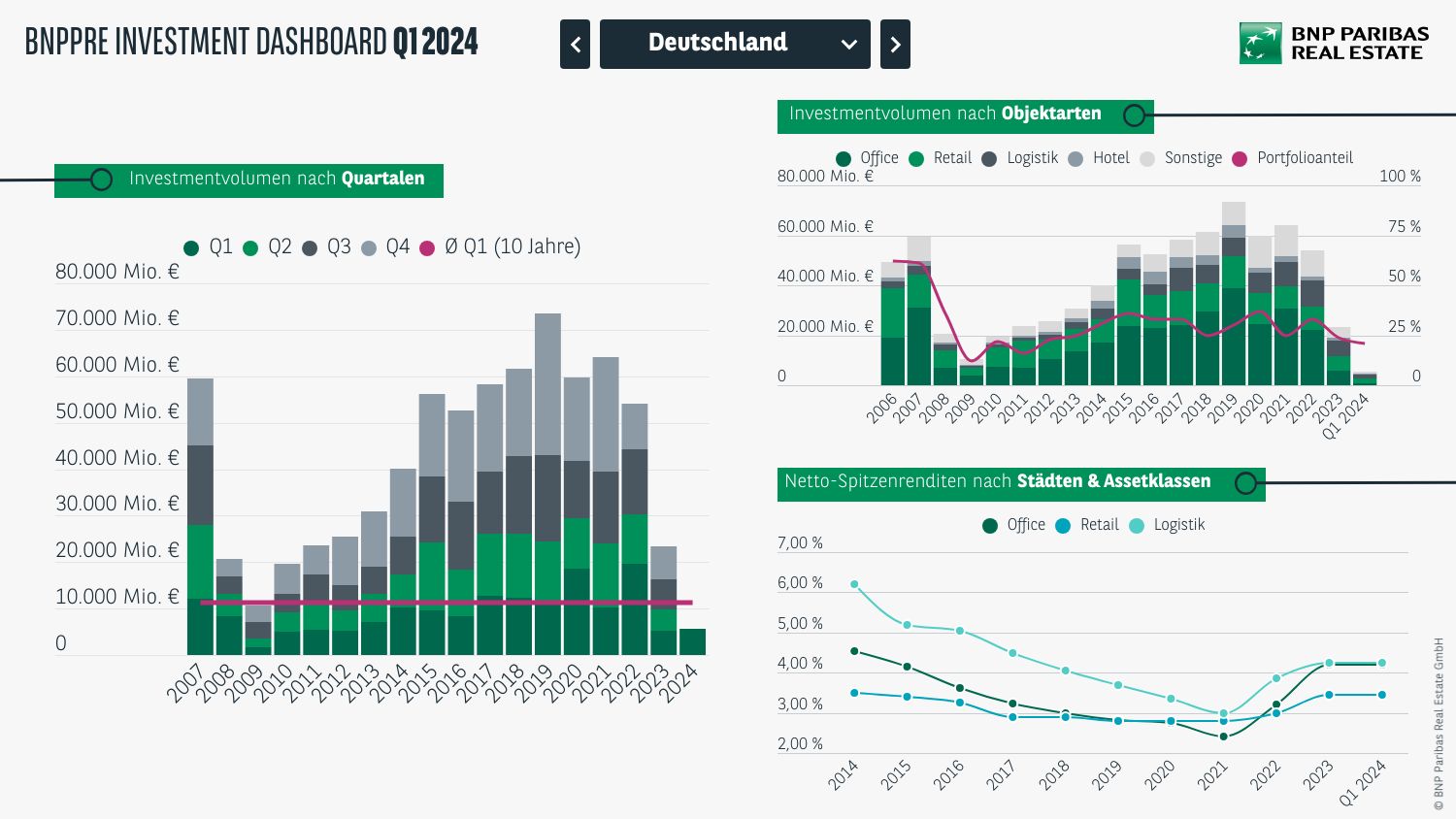

Investment market key figures

Commercial investment market Q4 2025

The German commercial investment market remained stable overall in 2025, despite a continuing challenging environment. The total annual investment volume is recorded at just under €34 billion. This is slightly below the previous year's result by -3.5%, although performance varied significantly across asset classes, including a remarkable 19.5% increase in office transactions and an almost 29% rise in hotel investments. Towards the end of the year, the market gained further momentum: with €10.2 billion, the final quarter showed the most lively months of the year. The strong last chapter of the year demonstrates that, in many cases, the investment pipeline became ready for transaction and processes were more consistently brought to a deal. Key factors were more realistic price expectations and better predictability of financing. Overall, 2026 is likely to be characterised by a broader deal base, even though market participants are expected to continue acting with discipline in their calculations and risk assessments.

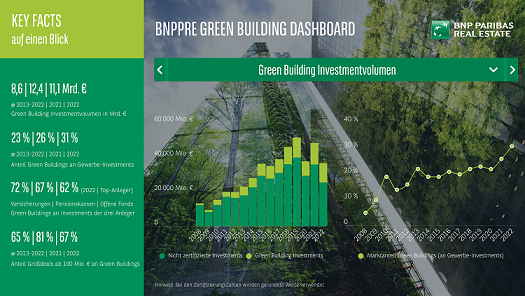

Green Building Dashboard

The share of certified green buildings within the commercial investment volume (excluding portfolios) remains at a very high level, even in a challenging market environment. After the top figure of just under 31% in 2022, around 27% was achieved in 2023. This is the second-highest share in the last 10 years and confirms the importance of green investments. While the EU Taxonomy mainly concerned companies in the real estate sector that wanted to place funds on the capital market, it is now affecting more and more market participants. Accordingly, sustainability regulations are becoming increasingly important for investors and buyers across the board, while at the same time occupiers (tenants and leaseholders) must now also take taxonomy criteria into account in their corporate governance. Against this backdrop, proactive management will remain the order of the day in 2024.

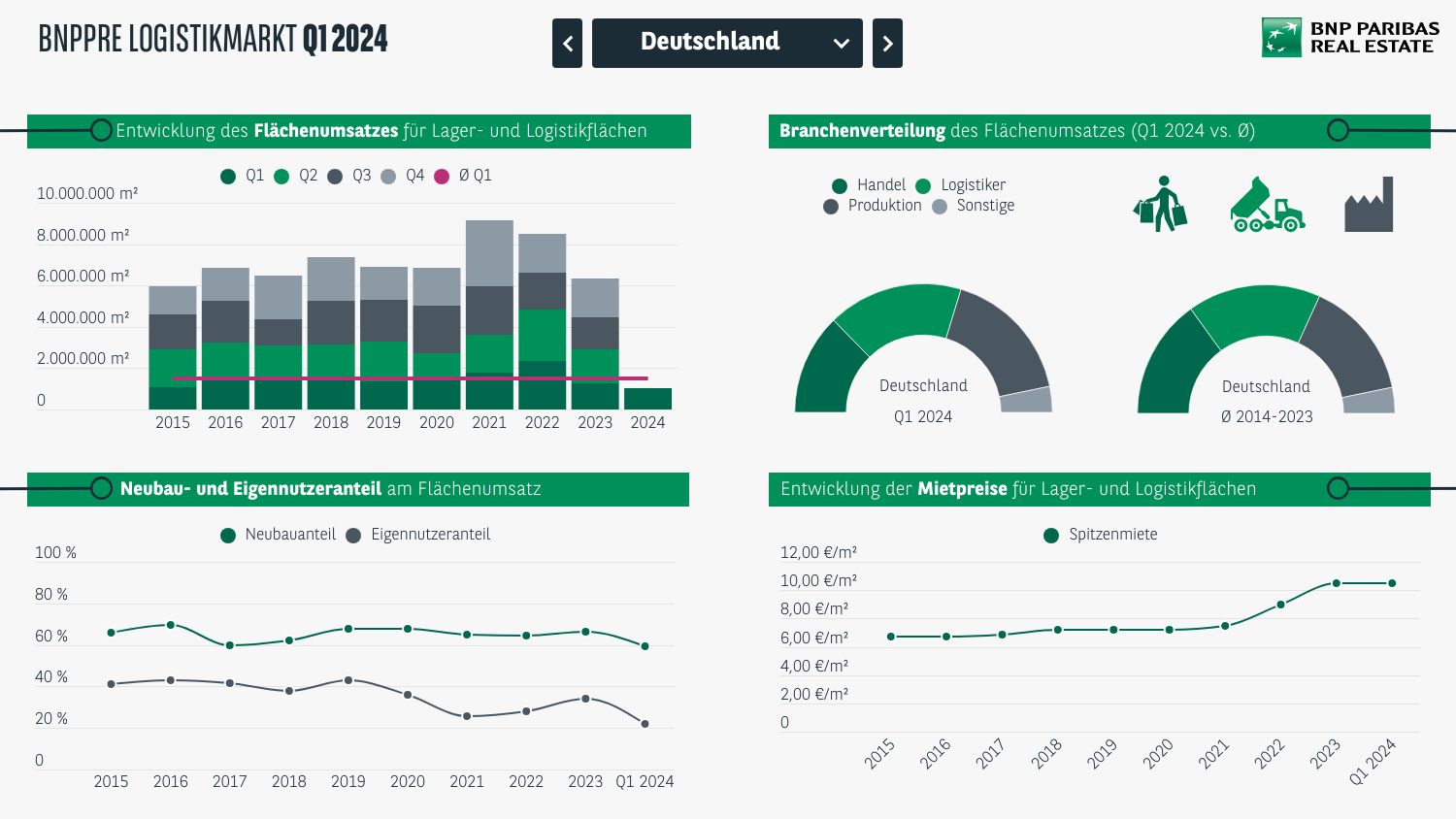

Logistics market key figures

Logistics market Q4 2025

The nationwide warehouse and logistics market achieved a take-up of almost 6.1 million sqm in 2025. This corresponds to a significant increase of almost 14% compared to the previous year. The logistics market is thus performing well in a weak economic environment and is showing a positive development over the course of the year. Nevertheless, the deviation from the ten-year average is 13%. Overall, more contracts were signed than in the previous year and, above all, a higher number of large-scale contracts were again recorded, which naturally have a strong impact on the overall result. The size category above 20,000 sqm increased by an impressive 30%. In this space segment, logistics service providers stand out in particular, accounting for almost half of the take-up in the segment of large contracts. This reflects the fact that many industries appreciate the flexibility of logistics service providers, especially in economically difficult times. In this context, it is also noteworthy that companies from the e-commerce sector are again much more active in the market, but often have their business handled by logistics service providers. The top logistics markets (Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Leipzig and Munich) grew by 15% year-on-year and closed the year with a combined take-up of 2.2 million sqm. In the course of the year, the rent level has risen slightly in most locations, both at the peak and on average.

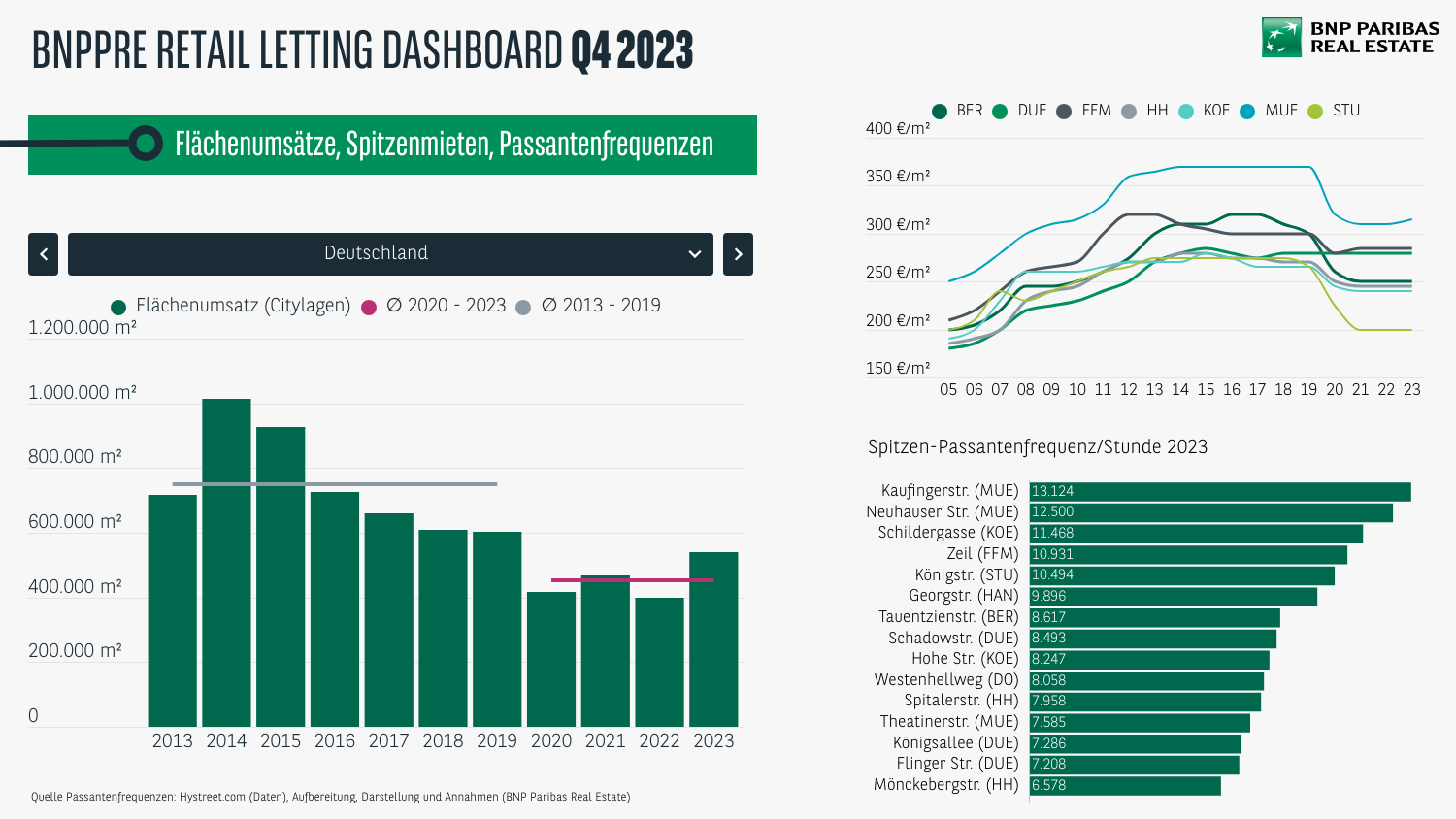

Retail market key figures

Retail market Q4 2025

The driving factors in the brick-and-mortar retail market once again created a mixed sentiment throughout 2025. On the one hand, the 4% decline in fashion sales in offline retail reflects the subdued consumer mood and increased tendency to save money regarding the still uncertain geopolitical and economic environment (source: Textilwirtschaft). On the other hand, footfall data analysed by BNP Paribas Real Estate and collected from the platform Hystreet.com highlights that this development cannot be attributed to a significantly lower level of footfall in city centers: In 2025, the number of people counted in prime locations remained stable, with a slightly positive trend observed toward the end of the year (November and December: +1.5%; December alone: +5%). Meanwhile, in the tension between good footfall and the often unsatisfactory conversion of potential in stores and at the checkout, a very dynamic market situation emerged in letting activities in inner-city locations, achieving the second-highest take-up volume since 2019.

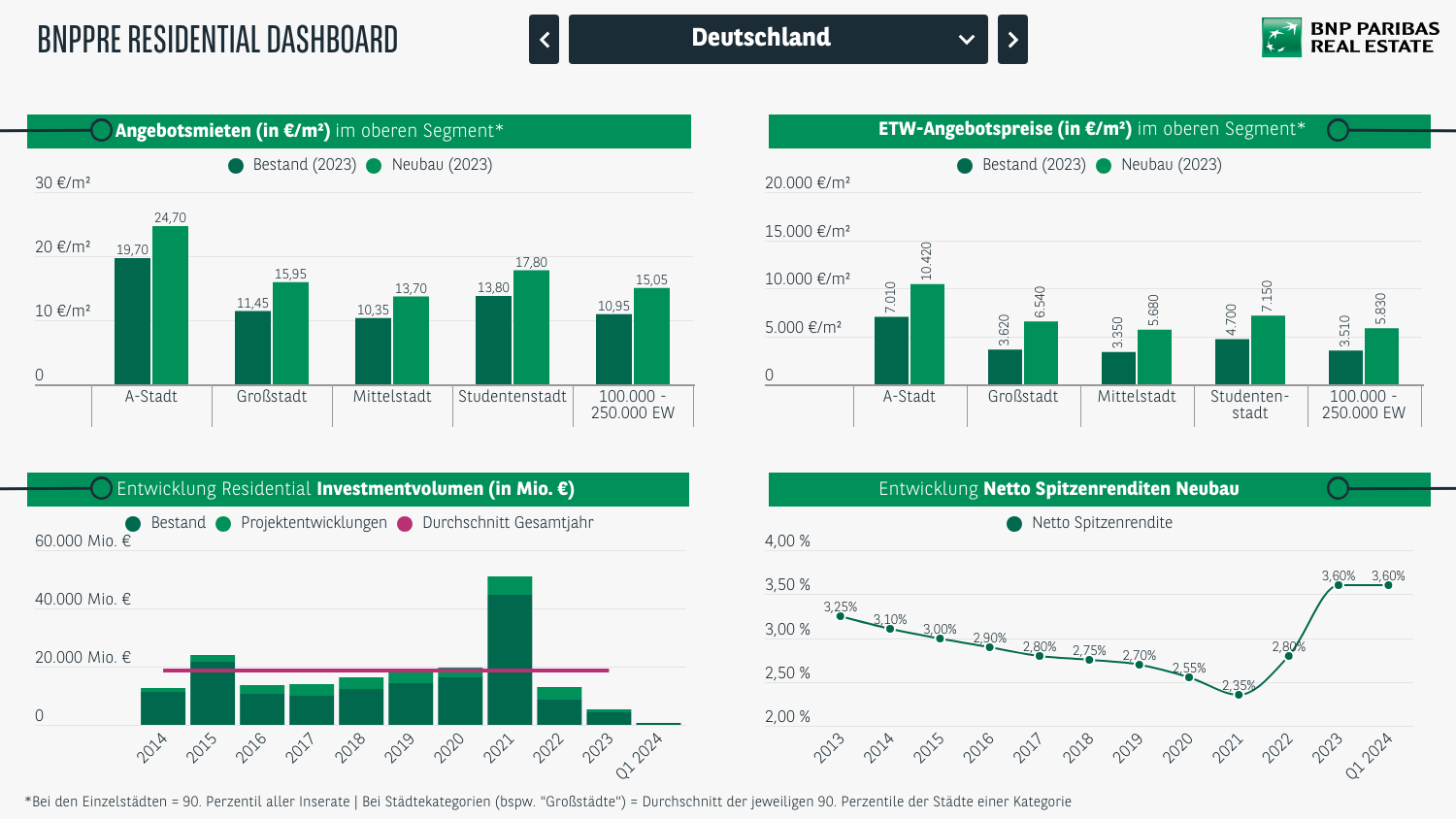

Residential market key figures

Residential Dashboard Q3 2025

After the first three quarters of 2025, the residential investment volume amounted to €6.3 billion. Thus, residential continues to hold first place as the most lucrative asset class in the German real estate market even after nine months. The significantly improved sentiment is supported by forward deals, which have gained in importance. In addition, the noticeably increased weight of large-scale nationwide portfolios, as well as the renewed interest in the value-add segment, contribute significantly to the sustainable recovery of the market. For the final quarter, a continuation of the upward trend is expected, as many investment products that just entered the market in the second quarter have resulted in a large backlog of transactions yet to be completed. Given the very well-filled deal pipeline and the prospect of further portfolio restructurings, an investment volume in the double-digit billion range by the end of the year appears realistic from the current perspective.

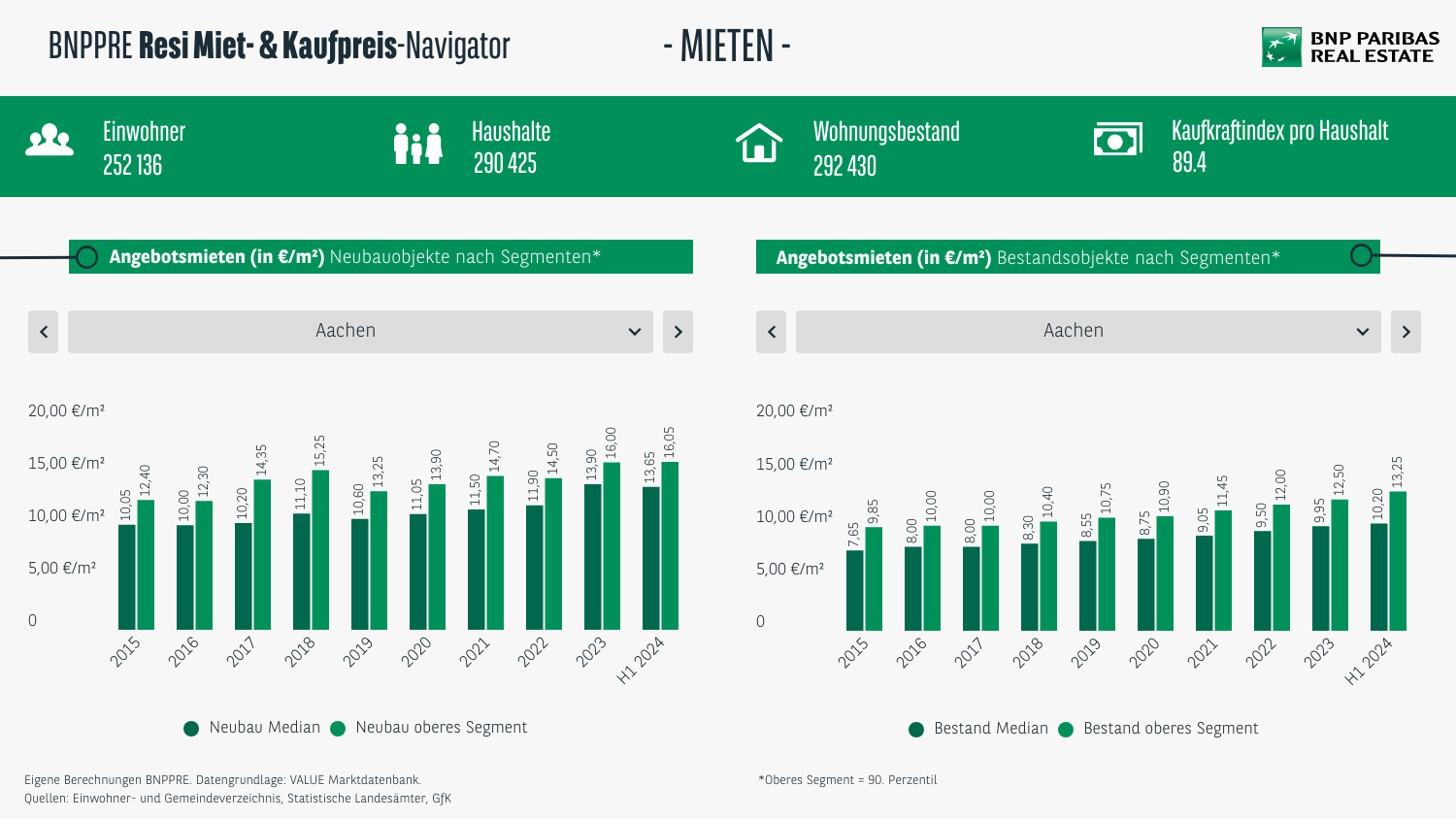

Residential rental & purchase price navigator

The residential markets of the most popular metropolises in Germany have been dominated by rising rental and purchase prices for years. But what is the situation in the rest of the country? BNPPRE investigated this question and analyzed all 108 independent cities in Germany. With the BNPPRE Residential Navigator, which is updated every six months, you can make further progress through the numerous residential markets and keep an eye on rental and purchase price developments (for condominiums) in the new builds and existing stock as well as other key figures.

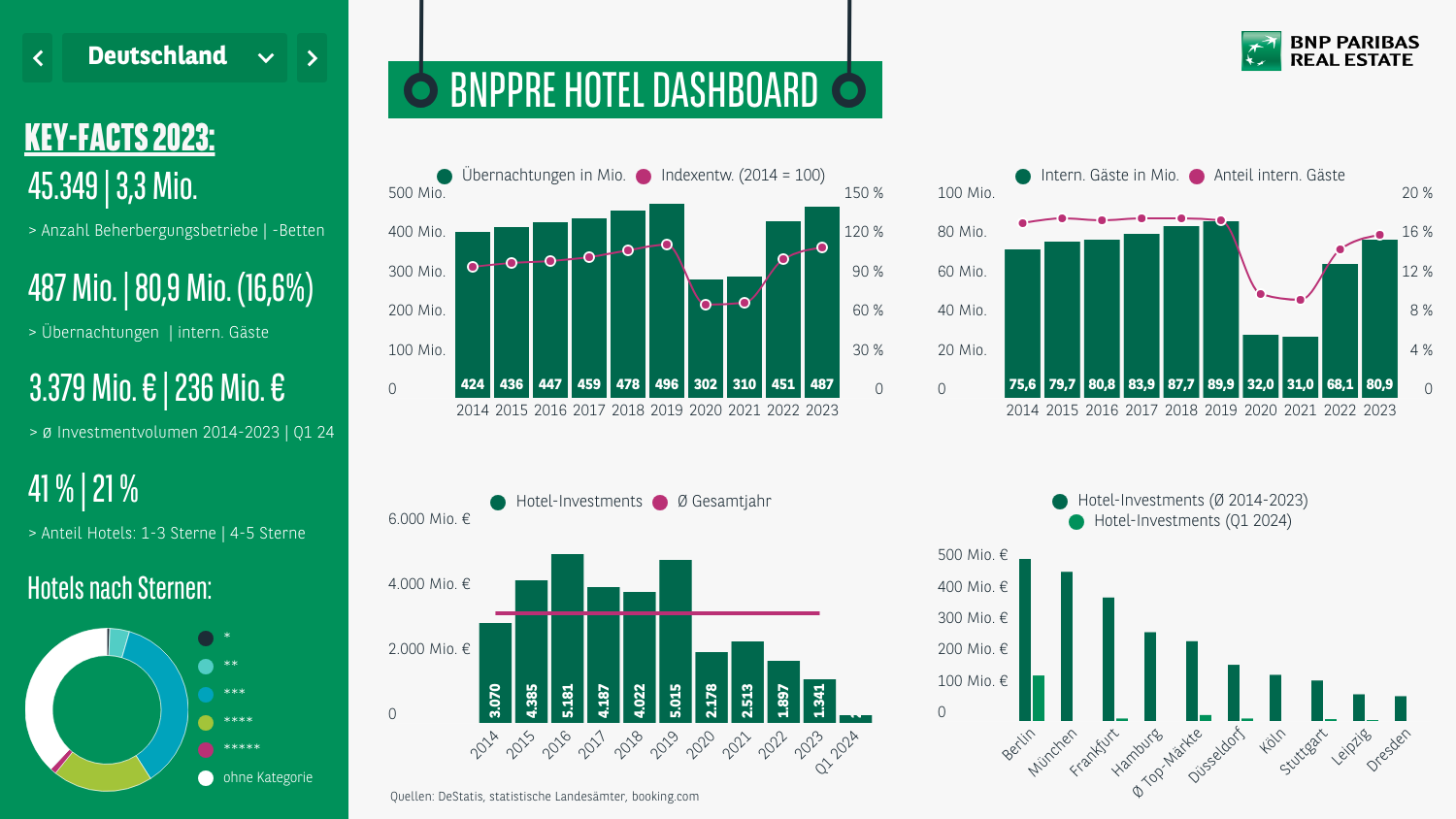

Hotel Dashboard Q3 2025

The increased interest in hotel investments, evident for some time now, is also reflected in transaction volumes. With a total turnover of nearly €1.43 billion, hotels have boosted their volume by almost 44% compared to the same period last year, achieving their best result since 2021. By the end of September, the 12-month volume from the previous two years had already been surpassed. Particularly noteworthy is the positive market momentum over the course of the year, as evidenced by two very strong quarters with investment volumes of almost €600 million each, following a rather weak start to the year due to a shortage of available product from 2024. Also encouraging is the upward trend in the portfolio segment, which reached nearly €380 million - the highest volume since 2020. At the same time, the volume of individual transactions has, for the first time since 2022, exceeded the €1 billion mark. There is a high probability that this asset class is now at the beginning of a new cycle. This presents investors with excellent entry opportunities to benefit from the expected yield compression.

The Hotel Dashboard from BNP Paribas Real Estate provides an overview of the development of hotel investment and performance indicators in the various top markets in Germany.

Hotel market key figures

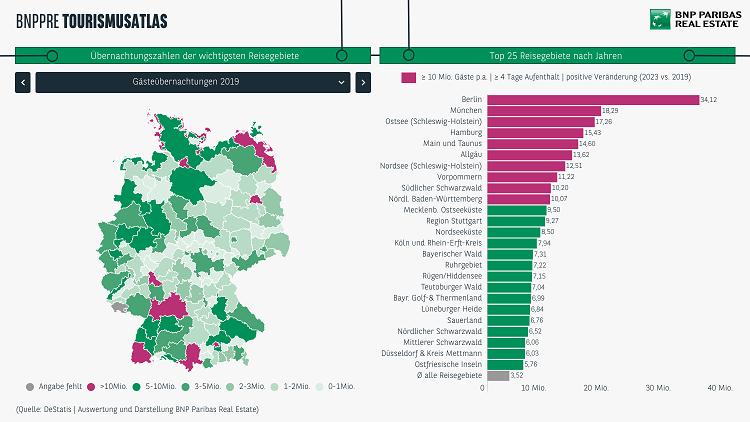

BNPPRE Tourism analyser

On the German hotel market, all key performance data indicates a sustainable recovery in tourism in Germany after the challenging COVID-19 years of 2020 and 2021. Significant increases in overnight stays by guests in accommodation establishments were already evident in 2022 (+49%) and 2023 (+61%). In 2024 around 496 million overnight stays were recorded, which not only exceeds the pre-COVID-19 figure from 2019, but also represents a new record in a long-term comparison. This reflects the resurgence in demand from city and business tourism as well as guests from abroad. Compared to the previous year, the number of overnight stays by foreign guests rose by a good 5% (85 million guests in 2024). Other key figures such as room occupancy and average prices also developed positively. By 2024, the occupancy rate had returned to a high level of just under 67% nationwide. The top 5 most popular travel destinations in 2024 are Berlin (31 million guests), Munich (20 million guests), the Baltic Sea (19 million guests), Hamburg (16 million guests) and the Main/Taunus region with 15 million guests. Furthermore, 52 million overnight stays were already registered between January and February 2025 - a strong signal for a continued positive trend in the current year.

While some dashboards are no longer up to date, they still offer an exciting insight into the various markets. Scroll through our dashboard archive here:

KEY FIGURES AND ANALYSES

ON THE GERMAN REAL ESTATE MARKET

Find out more about the latest developments in the investment, office, logistics, retail, hotel, healthcare and residential real estate markets to base your property decisions on a strong foundation of solid market information. We are happy to provide you with an extensive overview of property-related developments throughout Germany and details of the real estate markets of the largest German cities.